The upstream raw materials of PCB mainly include copper clad laminates, copper foils, copper balls, prepregs, gold salts, inks, dry films and other chemical materials. Downstream applications include communications equipment, computers, consumer electronics and automobiles. Since 2016, the PCB industry as a whole...

The upstream raw materials of PCB mainly include copper clad laminates, copper foils, copper balls, prepregs, gold salts, inks, dry films and other chemical materials. Downstream applications include communications equipment, computers, consumer electronics and automobiles. Since 2016, the overall PCB industry has recovered, and the development of the industrial chain has also changed.

In the past two years, the market size of the PCB industry has declined, mainly due to the attenuation of the driving force of consumer electronics such as PCs, tablets and smart phones. It is an indisputable fact that the traditional consumer electronics market is becoming saturated. Many categories have slowed down or even experienced a decline, which has dragged down the development of the PCB industry. From 2017 to 2022, the growth rate of consumer electronics PCB demand is expected to be 2.5%, which will further weaken the driving force for industry growth.

Upstream of PCB industry industry chain

The upper, middle and lower reaches of the PCB industry are clearly divided. The upstream industry mainly includes raw material suppliers such as copper clad laminates and copper foils. Generally speaking, the cost of raw materials in the PCB industry accounts for more than 50% of the total operating cost, which is the part that has the greatest impact on the gross profit space of PCB companies. Take Shennan Circuit as an example. In 2017, its direct material costs reached 2.349 billion yuan, accounting for 55.60% of operating costs, far higher than direct labor, manufacturing costs and outsourcing costs.

In the past two years, the effect of rising prices of raw materials has been prominent, which has a certain impact on PCB companies. Take copper foil as an example. Since the second half of 2016, copper foil has entered a price increase cycle, reaching a maximum of 110 yuan/KG. The price has been adjusted in 2017, but it is still at a relatively high level. However, with the adjustment of copper foil production capacity, a smooth price transmission mechanism will enable leading copper clad laminate and PCB manufacturers with bargaining advantages to pass on the pressure of rising raw material costs, thereby gaining greater performance flexibility.

Downstream of the PCB industry chain

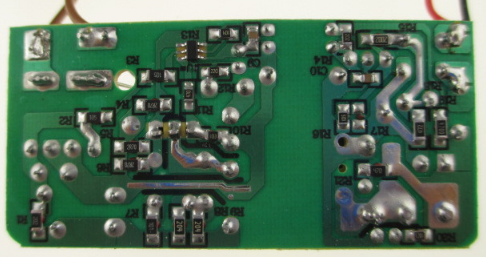

The downstream of the PCB industry covers almost all electrical circuit products. The core applications with the largest output value include communication equipment, computers, consumer electronics and automotive electronics. With the development of electrification and automation in human society, the application range of PCB is becoming wider and wider.

In 2016, in the Chinese market, communications, automotive electronics and consumer electronics were the three areas with the highest demand for PCBs. Among them, the communication field with the largest demand for PCB applications, accounting for 35%; followed by automotive electronics, accounting for 16%; consumer electronics ranked third, accounting for about 15%; other fields accounted for less than 10.